The Eighteen Year Real Estate Cycle |

People fall in love with having a “dream home,” and cost is usually secondary. They get into debt up to the eyeballs.

People fall in love with having a “dream home,” and cost is usually secondary. They get into debt up to the eyeballs.

Really bad idea, particularly right now. That’s because we’re at the very top of the market. In fact, it’s a bubble … certainly in Canada (and Australia is close behind). The US had their housing bubble a few years ago … but the full extent of the downturn is still to be seen.

We’re in a Worldwide Real Estate Bubble

Central banks have lowered interest rates to almost nothing in order to spur more borrowing. However, it results in more people buying homes they can’t really afford, and artificially drives up the price of those homes.

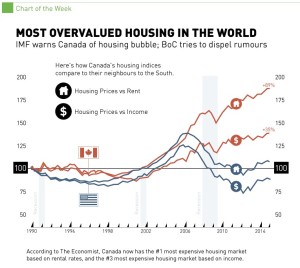

Here’s a visual from an article I clipped from zerohedge.com in March of this year about the Most Overvalued housing market in the world … by the Economist, a well-respected international financial magazine. You’ll find the full article here.

Here’s a visual from an article I clipped from zerohedge.com in March of this year about the Most Overvalued housing market in the world … by the Economist, a well-respected international financial magazine. You’ll find the full article here.

The other, possibly even bigger problem for Canada is that the International Monetary Fund (IMF) a month earlier than this article came out, sounded the alarm that Canada’s household debt is well above that of other countries. Canada (where I live) has the perfect storm just waiting to happen, and it won’t be long before it does.

But. guess who thinks it isn’t a problem? Stephen Harper, the past Canadian Prime Minister, and the Bank of Canada (Canada’s central bank) both tried to quell fears that anything is amiss. Of course, they’re both heavily biased.

Funny enough, I noticed another article a few days ago on the site Marketwatch, about Millennials (25 to 34 year olds, in this case in the US) and the concern that they’re NOT buying homes. You’ll find the complete article here. I say, “Good for them!”

Funny enough, I noticed another article a few days ago on the site Marketwatch, about Millennials (25 to 34 year olds, in this case in the US) and the concern that they’re NOT buying homes. You’ll find the complete article here. I say, “Good for them!”

People just don’t get it. But Millennials do!

Buying a home right now would be really foolish. It’s the top of the market. You’ll be underwater financially in no time.

There’s a little more to it than that, actually. There’s an even larger, longer cycle in play right now … the 172 year cycle. (you can see my video on it here) It’s bottoming. What this means it that the usual 18.5 year real estate cycle is going to go a lot deeper than normal. Longer cycles are more powerful than shorter ones.

The 18.5 Year Real Estate Cycle

Edward R. Dewey spent an entire chapter on it in his book, “Cycles, the Science of Prediction.”

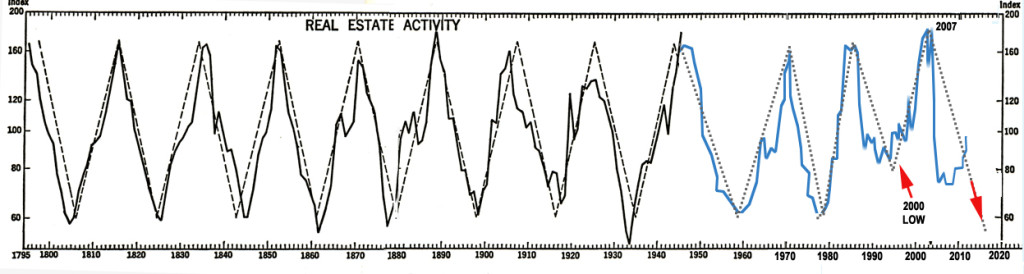

Above is a chart showing the pattern from 1795 through today. You can see how regular it is. It averages about 18 and a half years. If you’re smart, you buy a home at the bottom and sell (or keep it) at the top.

Above is a chart showing the pattern from 1795 through today. You can see how regular it is. It averages about 18 and a half years. If you’re smart, you buy a home at the bottom and sell (or keep it) at the top.

We had a major low in around the year 2000 in both the US and Canada. The US had a top around 2007 associated with the subprime crash. If you were to look at the appropriate chart (the real estate sector) in the US stock market, you’d see it peaking about now. It’s had a second top within the 18 year cycle. I would expect both the US and Canadian cycles to head down now and bottom in about 3 years.

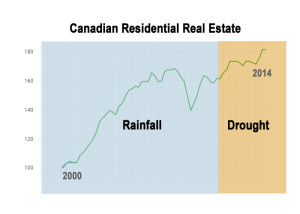

Here’s a chart of Canada’s real estate market over the past 18 years. It’s peaking right now and I would expect another low around the year 2018 … not very far away. The challenge with identifying the Canadian cycle is that they only started recording data about 20 years ago.

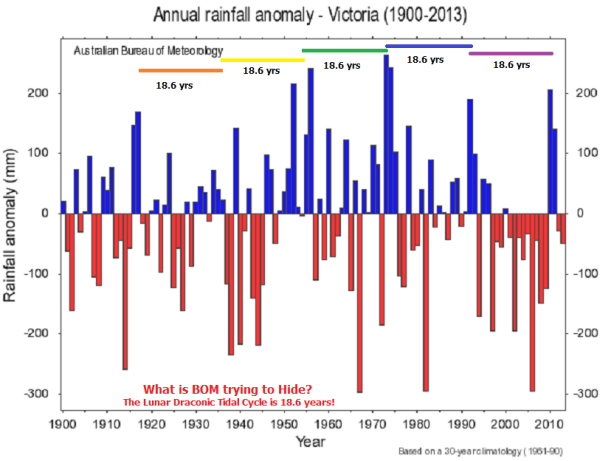

This 18.5 year real estate cycle is also a rainfall cycle. It’s called the 9.3 year rainfall cycle. Dr. Raymond H. Wheeler, the Father of Climate Cycles, found that it’s wet on the upside (wet leads to prosperous times) and dry on the downside (we’re in a drought right now … it’s getting cooler and dryer worldwide, which leads to depression). Droughts always lead to depression. They always have … throughout history.

Above is a rainfall cycle for Victoria, Australia, which shows the 18.6 year rainfall cycle in action (Source: TallBloke’s Talkshop)

Don’t get fooled by interest rates. As I mentioned earlier, central banks (like the Federal Reserve in the U.S., the European Central Bank, and the Bank of Canada) have instigated the lowest rates in history to try to spur the economy, but they’ve been unable to do it.

I’m expecting a very big crash very soon. The US stock market has already topped. Oil has tanked, but it’s got further to go. And interest rates are going up … quite a bit. Can you afford a big jump in interest rates? Well, I’d do the math before signing on the bottom line!

I’m expecting a very big crash very soon. The US stock market has already topped. Oil has tanked, but it’s got further to go. And interest rates are going up … quite a bit. Can you afford a big jump in interest rates? Well, I’d do the math before signing on the bottom line!

So … if you’re thinking about buying a home … think long and hard. Personally, I’d wait a few years until this bubble crashes and get in at the bottom. Some of us are projecting homes to be worth under 25% of what they are now in just five years – that’s not long to wait to get your dream home.

Edward Dewey, the Father of Cycles said:

“The building cycle is so long that most people don’t experience two cycles in their business life. For many individuals, an unfavourable first experience means a life-time tragedy.”

Pay careful attention to the real estate market, the stock market, and the economy. The central banks have created an extreme bubble and bubbles always burst. The signs are becoming more and more ominous. We’re likely only months away from a really large contraction.

Don’t let anyone tell you this time is different.

So what is the update on the real estate market now 5 years later? Interest rates are lower and people are offering thousands above the asking price, particularly in sought after water and mountain communities; at least in the SouthEast.

It depends upon where you live. I’ve been predicting a massive move from cities to rural areas. Rural areas will do well for a little while, but cities have been dying: The larger, the harder they’re falling. The coming 2000 point drop in the SP500 (likely starting in January) should negatively affect prices across the board. The urban to rural movement should continue for some time.

I bought property low in 2011 ….and has definitely ski-rocked in LA.. do you still consider selling?

Thanks

Hi Lilly,

We’re at an inflationary extreme now and I expect we’re going to see a dramatic turn into a deflationary environment, which will send the value of the US Dollar up and house prices down substantially. The bulk of the change may still be a year away. There’s a wrinkle in all this, as the Trump administration, which is still technically in power, is going to launch NESARA GESARA, which is a debt jubilee. They’re also planning on pegging the US Dollar to gold, which should be deflationary. When they are going to do this is the big question. I expect it to be within the year, but nobody knows exactly when. If that’t the case, we may see a deflationary environment quite quickly.

The big picture is that I still expect a stock market crash, a pegging of the dollar to gold, and a deflationary environment, which is overall deflationary. The bubble we’re in will burst. The question is when, but it’s sooner, rather than later (meaning likely within the next year). I don’t expect house prices to by much higher than they are now.

Glad to have found all this information on cycles, as I have been learning about cycles since 2008. I also see evidences of deflation everywhere. But, I can not understand why oil prices are increasing? JP Morgan analyst has predicted oil price up to 190 dollar oil by 2025 and called it an oil cycle. My thoughts are that it might be more market manipulation than an honest cycle. What are you thoughts on the causation of the price of oil increasing? Are we in a commodities super cycle of some sort or a supply chain disruption?

Also, would you have an idea if the stock market will crash before the real estate crash or will it be the real estate crash goes first? Are we able to sign up for the Thrive Academy? Thanks.

Hi Chase,

Apologies for the delay in replying. Been a very busy couple of weeks.

Oil is topping just like everything else at the moment. For the past three plus years, all asset classes have been moving closer in alignment so that now, they’re moving in lock-step. When the entire system is topping, everything has to top.

Your question on real estate is a complicated one. The entire financial system is about to change and we’ll be running two currencies in tandem, the fiat currency, and the new quantum currency (that won’t likely be it’s final name), but the new currency will be backed by gold and so have more value. That’s deflationary and house prices using that currency will be down in the 1960s area. Fiat is also going to move in a deflationary manner, more because it will be used less and less over the next few years until the market crashes altogether and we start over the scratch.

So, you’re witnessing a time in history where the Illuminati control of the population of the world has ended (that the current cycle revolution that has been covertly underway for the past 6 plus years). EVERYTHING is going to change before we get to Christmas. Everything you’ve ever been taught has been a lie. I’m in the process of re-writing the front page of the site. The site is all about what’s the come and how to navigate through all the changes (financially and otherwise).

The sign up for Thrive Academy is at https://thetruthsage.com/thrive-academy-signup/

There’s a ton of information inside the site … and we’re just waiting (almost any day now) for the round-the-clock broadcast system that’s going to wake up the rest of the population that’s still fast asleep. There’s going to be a lot of shock when they all find out what’s been going on and a steep learning curve to get aligned with the new world that’s pretty much already here, but still somewhat hidden from view.

Peter