Booms and Busts. Both are inevitable in our current fiat-money/debt-based financial system. There’s just no getting around it. It’s a system designed to pad the wallets of the banking community to the detriment of everyone else.

| “Whoever controls the volume of money in any country is absolute master of all industry and commerce. And when you realize that the entire system is very easily controlled, one way or another by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.” |

| President James Garfield, 1881. |

If you understand the concepts of inflation and deflation, that they’re a measure of the quantity and subsequent value of currency, and how our system works, then you know we have only one direction left to go – depression. That is, unless we change the system.

The system must be changed, or we’re about to witness the demise of civilization as we know it today.

The Basics of Inflation and Deflation

Inflation creates a “boom”; delation, just the opposite.

Inflation creates a “boom”; delation, just the opposite.

Inflation is an increase in the amount of currency in circulation. More money in society is good for commerce—to a point. It’s like everything else in terms of supply and demand—finding the right balance is key to a balanced economy. Left along, the market will regulate itself. However, bankers and governments both play a role of destroying both the market and our livelihoods.

Let’s take tickets to a soccer game as an example. If you build a new stadium in your city, you need to get the number of seats right for the size and interest of the community at large. If there are too few seats, the price of tickets is likely to go up, and may be prone to scalping. There’s not enough of them to fulfill demand.

However, if you build the stadium with too many seats, guess what? You’ll probably have to discount the price of the tickets to fill the stadium and may end up giving away a certain amount of them. Too many tickets reduces their value.

It’s the same with money. However, you don’t necessarily see the value of money fluctuate. There’s nobody selling a $20.00 bill at reduced rates. What happens is that the prices of products and services reflect the value of money.

If there’s lots of money in circulation (more than necessary to meet basic needs), then prices of products and services go up in price (e.g.- houses and cars). In actual fact, it’s money going down in value that causes prices to increase.

On the other hand, if people are losing jobs, and the economy is faltering, the value of money goes up—there’s not enough of it to go around. Therefore sellers of products and services have to discount their prices. There aren’t enough people with discretionary income to purchase those soccer tickets. You have to discount the price to make them affordable. That’s deflation.

The solution, of course, is to get more money in circulation. But, our monetary system makes it almost impossible to do that. After all, the government isn’t giving away money to everyone. (Well, not unless you live in one of the Nordic countries, like Sweden, Denmark, Finland, or Iceland, where they’re considering a basic income program).

To understand how money gets into the current monetary system in place in all the G7 countries, you need to understand fractional reserve banking.

Private banks (owned by private bankers) in all the G7 countries create money in their respective economies. When they create money, they’re also creating debt. To create debt, they need willing participants, like you and me, to take out loans. That how we create inflation. If there aren’t enough loans being created, the money supply deflates, and we go into deflation (a recession or depression).

The Basics of Fractional Reserve Banking – Making it REALLY Simple

We have a money system called “fractional reserve banking.” Sounds complicated, but it’s not. The government requires that private banks keep a fraction of the money they lend out in reserve. So let’s say that fraction is one tenth.

That means banks have to have on hand 10% of the money they lend out. If that sounds a little weird, that’s because it is. Actually, it’s downright crazy! It’s fraud.

Let’s say I open a bank – Peter’s bank. My slogan is “Loonie is my middle name.” Let me explain.

Let’s say I open a bank – Peter’s bank. My slogan is “Loonie is my middle name.” Let me explain.

In Canada, one dollar is in the form of a coin. It has a picture of a loon on it (even though the loon is not our national bird, it “flies wild” all over Canada—a slight nod to inflation, I suppose).

So I’m picking this slogan just so people know I’m really knowledgeable about banking (lol), and it speaks to the business of banking in general (as a double entendre).

I’ve been able to raise $10,000.00 in equity from investors and $5,000 in savings from clients. I’m going to peg $10,000 as the reserves I need and stick that in my bank vault for safe keeping.

I need a “float” (money to be used day-to-day for people who want change, to retrieve some of the deposits, etc), so I’ll go to the national treasury (in Canada, it’s actually the Bank of Canada that prints our bills and coins) and buy $5,000 worth of cash.

Nobody ever wants a lot of money, so the rule is you have to have enough cash on hand to handle day-to-day withdrawals for a period of 30 days. That’s all the amount of money a bank needs to keep on hand. With that, I’m in business! Scary, eh?

Let’s go back to the vault. There’s $10K in there and that means I can lend out $90k … because I have to keep 10% on hand. That’s the fractional reserve regulation in this case.

OK, now let’s say Fred comes in and needs a loan of $50,000.00. That’s OK because because 10% reserve banking allows me to lend out $90K, even though I only have $10K to back it up. Crazy, right? But, that’s the law.

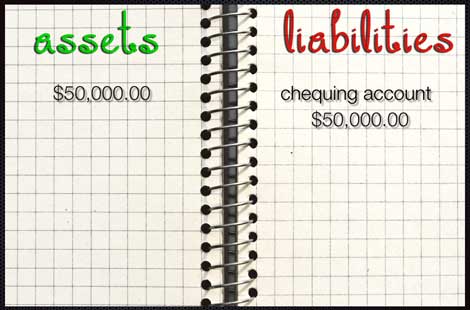

After he’s approved, I press a computer key and guess what, $50K appears in his account! It’s double entry accounting so it’s entered as a &50K liability to Fred (that’s the money I’ve placed in his account that he owes me back at some point). On the other side of the balance sheet, I also enter $50K as a bank asset, because I expect to get paid back, so I’m allowed to call it an asset … even though there’s not actually anything there.

After he’s approved, I press a computer key and guess what, $50K appears in his account! It’s double entry accounting so it’s entered as a &50K liability to Fred (that’s the money I’ve placed in his account that he owes me back at some point). On the other side of the balance sheet, I also enter $50K as a bank asset, because I expect to get paid back, so I’m allowed to call it an asset … even though there’s not actually anything there.

And voila … I’ve created money. Fred has 50,000 digital dollars that he owes me and I have an asset of $50K. Plus I still have another $40K (sort of) that I can lend out just the same way.

My payback is the income I’m going to get in compounding interest to allow me to keep that computer key greased up and ready to go again (that’s about all I have to do for the interest income). And the longer you don’t pay me back, the more interest you owe. In fact, if I get 10% in interest, after 7 years, I will have made $50K in interest payments. Pretty good business! A good return for pushing a button on a computer and greeting you at the door with a big smile!

Now, let’s say you bought a car and that $50K goes to the dealer. The dealer puts it in his bank account and you get your car.

Now this second bank has 50K of new money in the vault, and as long as the banker keeps it in the vault in reserve, he can loan out $450,000 in loans, even though he only has $50K to back it up.

This goes on and on and you can see that the new money increases many times over, as does the debt. In fact there’s a real incentive for private bankers to increase the money supply, because they have no costs (other than overhead), it creates an asset on the balance sheet, and they’re making money in interest as they sleep. It’s an upside down pyramid scheme. The more loans, the greater the debt, the risk, and the digital money in circulation.

That’s OK as long as the debt gets paid back on an ongoing basis and more money is created. But when the economy begins to falter, well, that’s when things get a little weird.

What happens is that first, the government lowers interest rates. This causes the population to think that the money is almost free and so they go to the bank for more loans. The banks aren’t making as much interest income on each loan, and so they’re happy to compensate by issuing more loans. After all, there’s really no additional cost to them to do so.

As a result, the bubble really takes off and grows and grows and grows. Real estate prices go through the roof, mortgages increase to less and less credit-worthy people until all the players start to lose confidence that all that debt will ever get paid back. Banks stop writing mortgages and loans. In fact, money and credit become tighter and all through the economy, there’s a bit of a “shudder.”

The banks are not really all that worried, because there’s deposit insurance, after all, and not everyone wants their money all at the same time … until they do.

And what we have then is a bank run. Because deposit insurance can handle less than one percent of the problem. It’s completely inadequate.

And that’s why in 1818, 1837, 1857, 1873, 1893, 1907, and 1929, there were runs on the bank.

That’s also why you want to pay close attention to what’s happening this year in the economy. Because if there’s even the slightest indication that any of the big banks are facing issues, I’d want to be the first one in line to get the “real” money you put in in the first place.

Feeding the Spiral

The bottom line is that more money in circulation fuels inflation. Everybody’s happy in the short term, because the economy appears to growing as prices gradually rise (we’ve been brainwashed into thinking this is good), even though the irony is that it’s slowly eroding our standard of living. Our wages simply don’t keep up with rising prices.

The bottom line is that more money in circulation fuels inflation. Everybody’s happy in the short term, because the economy appears to growing as prices gradually rise (we’ve been brainwashed into thinking this is good), even though the irony is that it’s slowly eroding our standard of living. Our wages simply don’t keep up with rising prices.

We’re also paying back those loans in tomorrow’s dollars, which are gradually being reduced in value because there are more of them in circulation, which makes the debt easier to pay off. But when deflation becomes the norm, tomorrow’s money becomes scarcer and increases in value, so it becomes more and more difficult to pay back yesterday’s loans.

Once we reach a certain point of inflation, prices reach such a height that we can’t afford the products and services. The economy levels off, purchases stagnate, people start to lose jobs, mortgages become harder to pay, real estate prices level off, and we start down that long, spiralling, deflationary road. Governments, although they promise just the opposite, usually add to the dilemma, with policies that are deflationary.

Here’s a list of the things that we, as well as governments and banks, do to exacerbate the problem—to feed the deflationary spiral. Once you get into a deflationary period, the last thing you want to do it take money out of the economy (out of circulation), because that only makes the situation worse.

Paying Down Debt: Under the current system, with double entry accounting, paying down debt actually makes money disappear—it takes it out of circulation. 97% of money these days is digital (it doesn’t really exist in reality—it’s a digital entry in a computer, moved from bank to bank) and when you reduce the liability side of double entry accounting, the asset side also gets reduced by an equal amount. Banks end up losing assets, which affects their credit-worthiness. In any case, money leaves the economy. It deflationary.

Hoarding Cash: There are two sides to this coin. In an inflationary economy, the wealthy get richer and the poor get poorer. The wealthy become so rich that they have more money than they can ever spend and it just sits there idle. Because they tend to own assets that attract interest or one type or another, there’s a never-ending stream into their bank account, taking even more money out of the economy as time goes on.

On the other hand, the poor and middle class start to lose confidence in the economy and in Europe these days, they’ve already started stashing money away in basements and mattresses. This reduces the “velocity of money,” which is another way of saying there are fewer and fewer transactions taking place (there’s less money in circulation).

Fewer Loans: Banks begin to worry about the amount of money they have out in there in the economy, particularly as loans start to go bad. Businesses start to fail and mortgages start to default. Banks start to reduce the number of loans they make, further reducing the amount of money they’re creating. Creating loans (debt) is the only way we have to create more money in today’s monetary system.

Another way to inflate is to reduce taxes, but in today’s world, for all the same reasons, governments are bankrupt, and lowering taxes is the last thing they’re going to do—they need the income too badly.

Compounding Interest: Compounding interest is the core of the problem. When you pay down debt, you’re actually reducing inflation. In other words, you’re paying back new money that was created out of nothing. But when you pay back interest, you’re paying it with existing money that’s already out there in circulation. In other words, you pay back the principle you borrowed, but you have to go out into the economy and find additional, existing money to pay back the interest you owe on top of the debt. This interest is taking money directly out of the economy. It’s deflationary.

Inflation: Inflation in itself, over a long period of time, actually causes deflation. It gradually lowers the value of our money until it’s worth so little that we can’t afford to buy any “nice-to-have” items. So we stop spending except for the basics. Retail sales tank. Business start to fail. This is deflationary.

Minimum Wage: The raising of the minimal wage is what finally killed the Roman Empire. The army demanded more money because the value of the currency of that time had declined to about 5% of its original value. Increasing the wages of the army (it was so large) bankrupted the treasury.

Today, raising the minimum wage forces employers to reduce the number of employees. That’s because deflation has already decreased the number of transactions and the amount that people are willing or able to pay for products and services. Employers end up getting squeezed on both sides. The rise in unemployment becomes a bigger drain on government and the economy in general. It’s a deflationary move and it always happens in the early stages of a deflationary environment.

Increasing Taxes: The recent move to energy taxes (we have an energy tax in my province of Alberta that 63% of the population disagrees with—and, of course makes no sense from an environmental perspective) that takes money out of the economy. Governments always do the most stupid thing at the most ridiculous time.

The Sharing Economy: The “sharing economy” is both a result of deflation and leads to additional deflation. It reduces the number of transactions in the economy and the dollar amount of these transactions, both of which are deflationary.

Rise of the Value of the Reserve Currency: This is an indicator of deflation. The US dollar is the reserve currency (still) and as it increases in value, it indicates the fact that deflation is increasing. When the value of money increases, there’s less of it in the economy. Prices of assets (houses and care, for example) decrease, along with wages, and employment.

Increasing Bank Reserves: As the private banks start to experience more and more bad loans, there’s a move by central banks to require them to increase their reserve percentages. When they do that, of course it reduces money in circulation. If you reduce reserves from 10% to 15%, that extra five percent is taking out of the economy and goes into the vault where it sits there waiting for the eventual bank run.

And this is only a partial list!

This is the crazy system we’ve had in place ever since the Bank of England was formed in 1694, a system based on usury, with the Rothschild family dynasty as the core. It’s a predatory system that’s ruined the world’s economy. It’s what the upcoming revolution is all about. It’s going to get really, really nasty. These banksters play hard ball and they don’t like to lose.

| “Let me issue and control a nation’s money and I care not who writes the laws.” |

| Mayer Amschel Bauer Rothschild (1744-1812) |

Peter

great article and the most focused cogent synopsis Ive read anywhere. the vast majority have not a clue of whats coming but increasingly in the headline and YouTube posts is an awareness that this will lead to civil war. Jim Rogers of Quantum Fund fame is late 70’s and has repeatedly said he just hopes we come out on the other side.

I have picked up a few acres in a rural areas. The cities look like a really bad place to be in the future. One of our Christian leaders has warned one of the most important things to consider in the future is where you llve. Unfortunately for most they have to live near where they can work.;

Very interested in the Thrive newsletter to see what you have to say about how to handle contingency situations. I am convinced cash will be eliminated completely and the powers that be will have our necks firmly in the noose. With the push of a button they can completely control your life.

really wondering if now is the time to buy gold? or maybe silver?? ………. or wait???

I tell everyone I can about your service.

Jason Hale

Thanks, Jason,

We will come out on the other side … the human race has been through this many times before. As I’ve been saying, there will be a large urban to rural migration and it’s already started to happen in the US. Central bankers would love nothing more than to have a totally digital currency worldwide, which would give them total control, but long before they get there, everything is going to crash, so it isn’t going to happen.

Society (and Mother Nature) always wins over the “satanists,” and it won’t change this time. We’re going into spiralling deflation in the US Dollar first, which will send gold down (as the dollar rises in value, gold will drop in price) and so gold is a good hedge, but not in deflation, until it’s not priced in US dollars anymore, which is some ways down the road, I think (like, not anywhere on the immediate horizon).

There will be a civil war in the US and it may last for quite a few years. That, and food, are the more immediate, largest threats.