Background

In the ’30s, ’40s, and 50s, several luminaries researched cycles in search of causes for the many recessions and depressions of the 19th and early 20th centuries. These well respected men each came to the same conclusions on their own, from different perspectives: Cycles occur throughout nature and affect virtually everything we do here on Earth.

However, in the six recent decades of economic expansion, much of their work has been ignored, as man’s hubris has taken over, governments have mushroomed, and technology has grabbed our focus as the magical answer to many of our problems. We somehow forget the fact that computers often spit out a convoluted version of what we put in.

When Economic downturns occur again (as they always do), humans revert back to seeking the truth as to why we can’t seem to control markets, climate, world health, or society in general. The search for truth eventually leads back to cycles, and to understand cycles, you need a good grasp of history, because history repeats … in cycles.

| “Those who do not remember the past are condemned to repeat it.” |

| George Santayana |

My objective through the work that I do, is to instill in businesspeople (and others) an awareness of nature’s cycles and their affect on the business environment. Man is far from being in control of anything affected by nature—that includes markets, the economy, the mood of the masses, climate, world health, or trends. Our ancestors knew this; we have since lost our way.

My programs focus on the practical application of cycles data to real world situations that affect us in business or in our personal lives. By understanding cycles, we can live a more prosperous life, much less affected by the cyclical changes in the mood of the masses, changes in climate, or ups and downs in the economy.

Keynote:

Mother Nature Means Business!

Audience: Leaders, executives, businesspeople. Their is a similar presentation for a nonbusiness audience with a slant towards protecting personal wealth.

Time: Typically one hour

The world is in turmoil. Stock markets are dropping, oil has crashed to a multi-year low, the economy is questionable, and unrest has broken out just about everywhere. What can we make of it?

The world is in turmoil. Stock markets are dropping, oil has crashed to a multi-year low, the economy is questionable, and unrest has broken out just about everywhere. What can we make of it?

Lots, actually. In fact, it’s all been forecast many years ago—just another cycle that happens over and over again throughout recordable history, with a highly predicable rhythm. Nature’s cycles dramatically affect business, our general well-being, even the stock market.

We’re presently at the top of a major market downturn world-wide that will affect virtually every business, our freedom, personal safety, wealth, and health.

As a businessman or entrepreneur, it’s really important that you have a good grasp of how natural business cycles influence the playing field. It can spell the difference between financial failure and prosperity throughout your career.

In this session, Peter will take you back in time to show you how the past predicts the future. Then he’ll take to the reality of the present, and show you how it’s a repeat of the past. Finally, we’ll visit the immediate future, and how to take advantage of the cycle that’s coming.

You’ll learn:

- what the world’s richest family knew in the 1800s and kept to themselves

- how social, business, and political trends are predictable

- about the 172 cycle and its importance today

- the importance of 25, 100, 515 and 1030 year cycles

- how history rhymes and how it affects you today

- how governments rob from you without you knowing it

- what the strong trends of the next few years will be

- the prediction for the stock market, currencies, world health, and climate

- steps you can take to lower your (or you company’s) financial risk

- how climate, politics, your health and welfare, and the economy all march to the beat of natural cycles

Outcome:

This keynote will literally change the way you think about the world, your role in it, and your future financial opportunities.

You’ll learn how to know when to buy or sell a home, whether to rent or buy, what to do about debt, and how to build and keep your wealth. You will also gain a good understanding of how the ups and downs in the economy are highly predictable (and why economists are always wrong). Warning: this program may completely change your priorities and your life.

Peter Temple is a futurist, market analyst, strategic thinker, and cycles expert. For the past seven years, he’s been researching, analyzing, and more recently, forecasting market trends, so you don’t have to. If you want to know what’s in store for the economy, social mood, trends, climate, or world health, a one-hour keynote from Peter is the place to start.

Breakout sessions, board exercises, or intensive workshops

How to Profit from Deflation

Audience: Anyone who is concerned about their personal financial future. This is for the layman to make the world of money, finance, and debt super easy to understand. If want to get to the facts right now about what’s really going on in the economy, and get some solutions you act upon, this is the session for you.

Time: Typically one to two hours.

Inflation has been the norm ever since you were born. That’s because governments create monetary policy through interest rates to attempt to keep it at about 2% a year. They tell you that’s a good thing. But is it really?

The world on monetary policy is about to change, not because the government wants it that way … but rather because over 100 years of it had created a “house of cards.” That deck is about to collapse.Deflation is going to be the name of the game for some time to come.

Deflation increases the value of your money without you having to do anything at all. There are a lot more advantages to deflation, but only if you know what they are beforehand. It’s a radical departure from everything you’ve ever thought about your money and debt.

This session uncovers the myths about money, teaches how to take maximum advantage of deflation, and readies you for a whole new economy.

What this session covers:

- the world financial situation

- how governments rob you

- myths about inflation

- the fractional reserve banking ponzu scheme

- money vs currency (gold vs. fiat)

- what is deflation

- how deflation affects:

- real estate

- products and services

- investments

- investing in currencies

- what to do about debt

- bubbles in history and the result

Outcome:

This session will change the way you think about your money, debt, credit, and the role of government in destroying our wealth.

You’ll learn about what happens to assets during a deflationary spiral, where to invest your money, and how to hold onto the wealth you have now. You’ll also get a good solid understanding of the real value of the money you use every day and how to prepare for the future. Warning: this program may completely change your relationship with money.

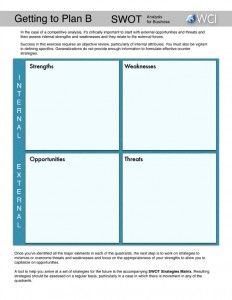

Getting to PLAN B

PLAN B sessions must involve the key stakeholders in your business. Typically at least a half-day facilitated session, it can lead to shorter, ongoing sessions to analyze progress and update the resulting strategic plan.

PLAN B sessions must involve the key stakeholders in your business. Typically at least a half-day facilitated session, it can lead to shorter, ongoing sessions to analyze progress and update the resulting strategic plan.

The focus in completing a PLAN B session is on identifying key strategies that will position your organization to take maximum advantage of the upcoming market downturn by understanding all the forces at play.

The challenge, of course, goes beyond identifying strategies and action plans. Your organization, no matter how large or small, is like a ship on the ocean. It takes teamwork to turn it around. The entire crew must respond in kind to the challenge, from the bridge to the engine room.

Changing the mindset and culture of the organization is going to mean everyone at the top must be fully onboard. The weakest link is often the one responsible for sinking the ship in times of crisis. Therefore communication within the organization is extremely important to the successful implementation of any strategic plan.

This exercise will help you to identify specific threats to ongoing profitability and develop counter-strategies to survive and thrive during the coming financial crisis.

It can be scheduled as a short break-out session, a comprehensive board exercise and discussion, or an intensive full-day workshop. It can lead to a more in-depth review of your entire marketing and communication strategy.

Using the SWOT framework in a facilitated session, together we develop a strategic plan for the near future, right through implementation.

The next ten years could be the biggest opportunity in your lifetime if you’re prepared to take advantage of it!

SWOT Exercise (the key tool used in the PLAN B session)

A SWOT exercise results in a strategic plan for the future for you or your organization. It concentrates on identifying the following factors underlying your organization’s economic prospects for the future:

- Strengths

- Weaknesses

- Opportunities

- Threats

Here are some of the areas addressed in a SWOT exercise:

Strengths and Weaknesses (Internal)

- Financial resources, such as funding, sources of income and investment opportunities

- Physical resources, such as your company’s location, facilities and equipment

- Human resources, such as employees, volunteers and target audiences

- Access to natural resources, trademarks, patents and copyrights

- Current processes, such as employee programs, department hierarchies and software system

Opportunities and Threats (External)

- Market trends, like new products and technology or shifts in audience needs

- Economic trends, such as local, national and international financial trends

- Funding, such as donations, legislature and other sources

- Demographics, such as a target audience’s age, race, gender and culture

- Relationships with suppliers and partners

- Political, environmental and economic regulations

| Contact Peter | |

|---|---|

|

About Peter

(403) 264-9111 |

Recent Comments