For the past twelve years, I’ve been predicting a dramatic downturn in both the stock market and the economy. In fact, I predicted the most recent turn down in the stock market in February of this year. I predicted Donald Trump would be elected President (populist leaders get elected at major cycles tops).

There’s a secret to predicting the future: It’s knowing the past; it really does repeat! My work is in helping people understand how Mother Nature works (how our Solar System influences us). Knowing about natural cycles helps you understand what’s really happening in the world, how to keep your wealth during challenging economic times, and how to stay safe.

So, as an introduction to the concept, I put on:

A free webinar that will change your perspective on the future!

If you didn’t see the original webinar, you can view it here.

For many, these are uncertain times. For anyone that understands economic cycles, much less so. If you’re at all concerned about the future, this webinar should answer all your questions. (NOTE: the full webinar is about 90 minutes in length.)

My new service will help you understand what’s going on in the world and how to adapt to it. It will cut through the propaganda, the misinformation, and all the idiocy that seems to permeate society at even the highest levels.

It’s Thrive Academy and it technically starts July 1, 2020.

If you sign up before Thursday, June 25 at midnight EST. The price is $90.00 US for an annual membership for the first year.

Even though you sign up and pay now, your subscription day will be updated to July 1 when the service begins. Our privacy policy is located here.

| [wlm_paypalec_btn name=”Thrive Academy Annual” sku=”KB8AVG41″ btn=”pp_checkout:m”] |

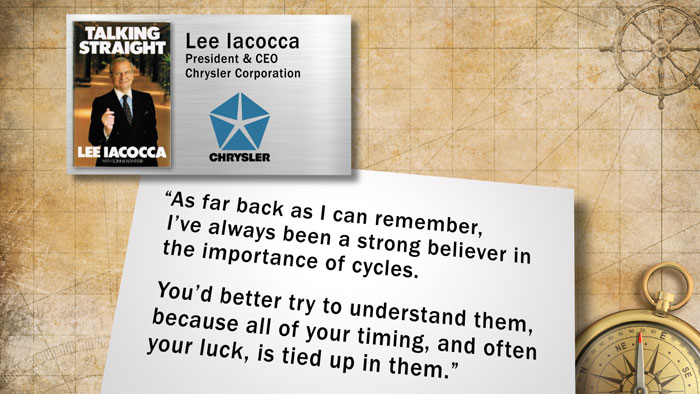

History repeats in cycles. It doesn’t EXACTLY repeat; often we say “It rhymes.” But the cycles are consistent enough that you can predict changes in social mood, the economy, money, health, politics, and climate, among other things.

The problem is that these major downturn cycles don’t happen twice in a lifetime. The important ones span over a hundred years. History shows that there’s a major depression in every hundred year period. That happens to be the cycle we’re heading into — the depression cycle. This particular cycle is a large one, one that happens every 500 years (roughly).

If you understand how these cycles play out and why, you can adjust your business strategies and personal life to accommodate. In this webinar, I’m going to share with you the basics of cycles, what’s really going on in the world, and how to make sure you thrive in the coming downturn (that’s right … it’s not over — in fact, this downward cycle is just beginning).

If you know the rules, you can win at the cycles game! I’m going to show you what you can do to prepare for this cycle, one that’s played out over and over again throughout human history.

“Those who cannot remember the past are condemned to repeat it.” — George Santayana

In Thrive Academy, I’ll cover:

- What’s really going on? — a look at what’s really going on in the world and an introduction to natural cycles.

- What governments aren’t telling you — seldom do governments tell the truth about anything. The truth is, they’re all bankrupt. I’ll cover what that means to your future.

- The truth about money and banks — money is changing value and banks are mortgage-holders, basically. When mortgages fail, banks go under. You need to know the rules about banks and your money.

- Investing in the “new economy” — investing has changed dramatically. I’ll show you where the stock market is going.

- Real estate — where prices are heading and what to do about it.

- What to expect going forward — a look ahead for the next ten years, based on history.

- How to prepare — I’ll explain what you can do to take advantage of the coming downturn. I’ll give you tips on safest places to live, how to protect your wealth and health, how to ensure you have enough of the right supplies (like water and food!), where climate is going, and paint a picture of what to expect going forward. You just don’t want to miss it!

It’s critical you have this information so that you’re prepared for what’s to come and perhaps more importantly, keep you sane, while all around you people are reacting to the crazy stories in the main stream media (the attempt of the government to control the narrative), and the growing anarchy that will grow in size is and dominate the headlines over the years to come.

It’s time to learn about the future and what’s in store. If you know what’s coming, you’ll know how to prepare. Squirrels know! They’re always prepared for “winter.”

Know the Past. See the Future.

________________________

Peter Temple is the founder of World Cycles Institute. He has extensive experience in developing strategies to align with natural and man-made business cycles and the economy. He has facilitated growth for investors and businesses, has developed multiple teams, and consulted on high profile IPOs for WestJet Airlines, Pengrowth Management, Big Rock Breweries, Enerplus, ARC Financial, and many more.

He’s the past executive director of the Foundation for the Study of Cycles, founded by Edward Dewey in 1841. Peter is also a speaker, market analyst, cycles expert, and book writer. A member of Mensa International.

People fall in love with having a “dream home,” and cost is usually secondary. They get into debt up to the eyeballs.

People fall in love with having a “dream home,” and cost is usually secondary. They get into debt up to the eyeballs.

Recent Comments